How To Create Cost Center

Cost Center Meaning

Cost center refers to those departments of the company which does not contribute in the generation of the revenue or profits to the company but at the same time costs are incurred by the company to operate those departments and include departments such as the Human resource department, accounting department, etc.

Types & Examples of Cost Center Accounting

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Cost Center (wallstreetmojo.com)

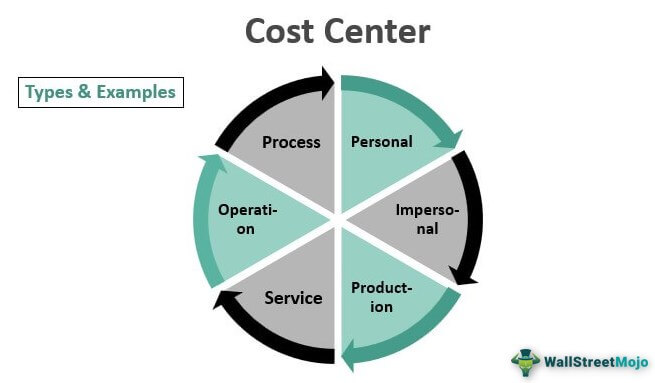

The expense center can be classified into the following six types based on the nature of business activities:

#1 – Personal

This type of expense center deals with a person or group of persons.

#2 – Impersonal

This type of center deals with a location or equipment or both.

#3 – Production

This type of expense center deals with a product or manufacturing work. Few examples of production centers are welding shop, machine shop, grinding shop, painting shop, polishing shop, assembly shop, etc.

#4 – Service

Suppose a cost pool deals with or is associated with rendering services to a production center. A few examples of this type of cost center are transport, stores, accounts, power, personnel department, etc.

The service center is further sub-divided into three categories which are as below:

- The material service center – Example include stores, internal transport, etc.

- The personal service center – Example includes the labor office, canteen, etc.

- Plant maintenance center – Examples include tool room, carpentry, smithy, etc.

#5 – Operation

Suppose an expense center consists of machines or persons who are involved in similar activities. This type of cost pool is relevant to manufacture concerns.

#6 – Process

Suppose a cost pool deals with a particular or specific process of a manufacturing enterprise. This type of center is also relevant to manufacturing concerns.

Cost Center Accounting

Cost Center Accounting is a departmental division, self-division, or a group of machines or men used for the purpose of cost assignment and allocation and includes various units of activity required in a manufacturing plant or other similar operating set-up.

- It is a unit that generates cost but does not generate any revenue. In short, it can be seen as a unit that consumes resources but does not contribute to the production, sales, or profitability of the business per se.

- A cost center is also known as a cost pool or expense center.

- For instance, let us take the example of the accounting department and the legal department of a company. Although both the departments consume reasonable resources of the company, neither of these departments directly help in product manufacturing or increase sales in any way. This does not mean that these departments are not necessary because they can save the company money in the long-term through other allied activities, i.e., the accounting department The accounting department looks after preparing financial statements, maintaining a general ledger, paying bills, preparing customer bills, payroll, and more. In other words, they are responsible for managing the overall economic front of the business. read more supports the preparation of financial statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more and tax reporting, while the legal department shall take care of any legal disputes.

Relevance and Uses

The primary purpose of a cost pool A cost pool is a strategy to identify the company's individual departments or service sector costs incurred. It determines the total expenses incurred in manufacturing goods and allocates them to different departments or service sectors based on valid identifiers known as cost drivers. read more is to create a distinctly identifiable department, division, or unit of an organization for which concerned managers will be responsible for all its associated costs and for ensuring adherence to the organization's budgets. If the responsibility is assigned to a manager, cost control Cost control is a tool used by an organization in regulating and controlling the functioning of a manufacturing concern by limiting the costs within a planned level. It begins with preparing a budget, evaluating the actual performance, and implementing the necessary actions required to rectify any discrepancies. read more becomes much easier. As such, cost centers are also known as "Responsibility Center."

A cost pool indirectly supports a company's profitability by improving operational efficiency, which results in better customer service or an increase in product value. An expense center can also help the senior management to understand resource utilization better, which will eventually assist them in utilizing the resources optimally through smarter techniques. Further, accounting for resources in such detail allows a company to forecast and calculate more accurately based on expected future changes.

For internal reporting, the cost pool provides relevant information to improve operational efficiency and maximize profit. On the other hand, it is of very little use for external users such as taxation authorities, regulators, creditors, investors, etc.

Given below are the terms related to the cost pool.

#1 – Responsibility Accounting

The concept of responsibility accounting Responsibility accounting is a system of accounting where specific persons are made responsible for the accounting of particular areas and cost control. In this type of accounting system, responsibility is assigned based on a person's knowledge and skills. read more revolves around a company's internal accounting and budgeting. The main objective of the accounting type is to help a company in planning and control its expense centers, which are also known as responsibility centers The term "Responsibility Center" refers to a specific segment or unit of an organization for which a specific manager, employee, or department is held accountable and responsible for its business goals and objectives. read more .

Usually, responsibility accounting entails the preparation of the budget (annual or monthly) for each cost pool. After that, all the transactions of the company are classified by cost pool, and a periodic report is created, which is the input for further cost analysis. The reports capture the actual expense vis-à-vis the budgeted expense, which helps in the determination of the variance between the budgeted and the actual amounts. Consequently, responsibility accounting provides the company the periodic feedback of each manager's performance.

#2 – Profit Center

A profit center is an organizational division that is accountable for its own profitability on a standalone basis. A profit center is responsible for controlling its own cost and generating revenue and consequently for its own net earnings Earnings are usually defined as the net income of the company obtained after reducing the cost of sales, operating expenses, interest, and taxes from all the sales revenue for a specific time period. In the case of an individual, it comprises wages or salaries or other payments. read more . Hence, managers have the authority to make decisions for matters related to product pricing and operating expenses Operating expense (OPEX) is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery. Therefore, they are readily available in the income statement and help to determine the net profit. read more . All the different profit centers Profit Center is the segment or division of a business responsible for generating revenue & contributing towards its overall profit. Here, the objective is to increase sales & reducing the cost incurred. read more within an organization can be ranked from being the most profitable to be the least profitable.

#3 – Investment Center

An investment center is an organizational division that contributes to a company's profitability by efficiently utilizing the capital. A company usually evaluates the performance of its investment center based on the revenue generated through capital investment Capital Investment refers to any investments made into the business with the objective of enhancing the operations. It could be long term acquisition by the business such as real estates, machinery, industries, etc. read more . An investment center is also responsible for its own revenues, expenses, and assets. An investment center is also known as an investment division.

Recommended Articles

This has been a guide to what is Cost Center Accounting and its meaning. Here we discuss the top 6 types of cost centers along with practical examples and its relevance and uses. You may learn more about our articles below on accounting –

- List of Operating Expenses

- Relevance in Accounting

- Prudence Concept in Accounting

- Single Entry System in Accounting

How To Create Cost Center

Source: https://www.wallstreetmojo.com/cost-center/

Posted by: listergioncy.blogspot.com

0 Response to "How To Create Cost Center"

Post a Comment